Home

/

Producers & Agents

/

RFP Requirements

RFP Requirements

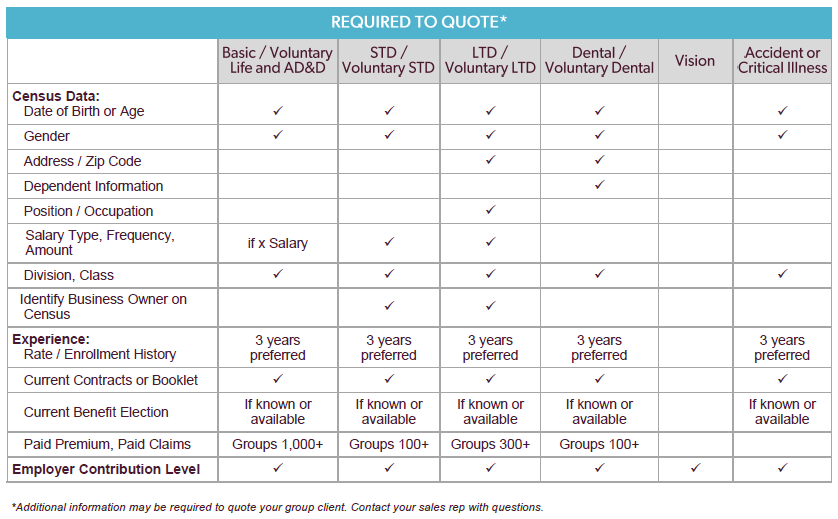

Looking for a quote? We're ready to help. First, we need some information from you in order to provide an accurate quote in as short a timeframe as possible.

A copy of the bid specifications must include:

- Name of the group (legal and DBA)

- Form or type of organization (S-corp, C-corp, LLC, LP, etc.)

- Nature of business with SIC and/or NAICS codes

- Location of group

- Years in business

- Agency and agent name

- Current commission levels and requested commission levels if different from LifeMap standard scales

- Employer contribution toward premium

Census data:

(Excel format is preferred for speed and accuracy of quoting. If desired, the template below can be used for groups with 25 or more employees. If you have an Small Group with 2-25 employees, visit the Small Groups page.)

Download Our RFP Requirements Template

Individual Business

Small Group Business

Submit Your RFP

Groups with 2-25 Employees

Helping Small Groups of 2-25 employees has never been easier. Get a quote from LifeMap within 3 full business days. Just submit a complete RFP and census to SmallGroup@LifeMapCo.com.